May 9, 2023

Great-West Lifeco reports first quarter 2023 results and enhances reporting in-line with IFRS 17 implementation

This earnings news release for Great-West Lifeco Inc. should be read in conjunction with the Company’s Management Discussion & Analysis (MD&A) and Consolidated Financial Statements for the period ended March 31, 2023, prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board unless otherwise noted. These reports are available on greatwestlifeco.com under Financial Reports. Additional information relating to Great-West Lifeco is available on sedar.com. Readers are referred to the cautionary notes regarding Forward-Looking Information and Non-GAAP Financial Measures and Ratios at the end of this release. All figures are expressed in millions of Canadian dollars, unless otherwise noted.

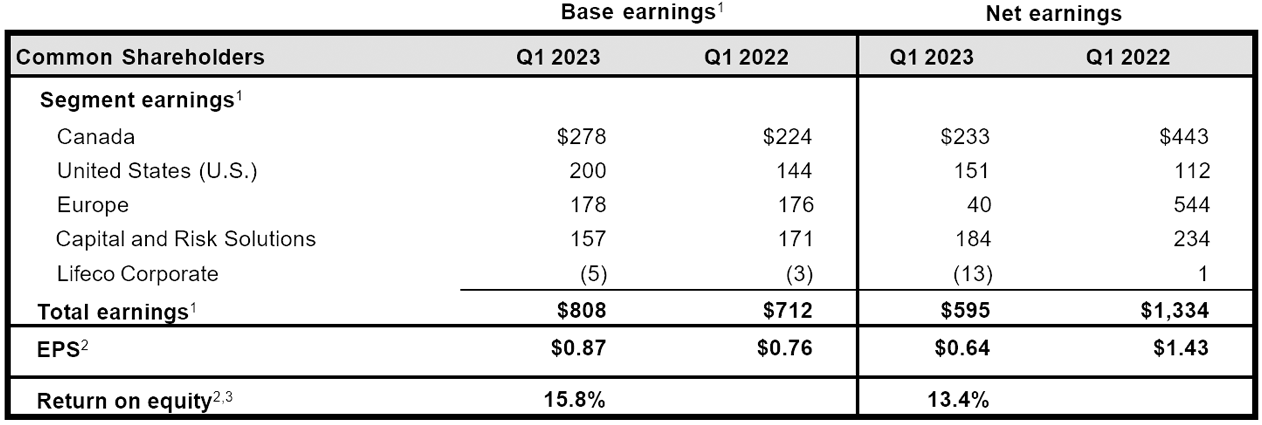

- Base earnings1 EPS of $0.87 or $808 million increased by 14% or $96 million from a year ago

- Net earnings EPS of $0.64 or $595 million compared to $1,334 million a year ago

- The Company introduced three Value Drivers for describing its business: Workplace Solutions, Wealth & Asset Management and Insurance & Risk Solutions.

Winnipeg, May 9, 2023 – Great-West Lifeco Inc. (Lifeco or the Company) today announced its first quarter 2023 results and the successful implementation of IFRS 17.

“Our strong results reflect the successful execution of our integration programs in the U.S. and continued focus on delivering consistent performance in each of our core businesses,” said Paul Mahon, President and CEO, Great-West Lifeco. "With the strategic acquisitions in the U.S. and of IPC in Canada, we are positioning our portfolio to deliver even greater value for clients, advisors, and shareholders.”

“The successful implementation of IFRS 17 is the culmination of a significant multi-year enterprise-wide initiative. Under this new reporting standard, we’re seeing strong base earnings growth, alongside expected increased net earnings volatility,” said Garry MacNicholas, EVP and CFO, Great-West Lifeco. “This volatility is driven by the de-linking of asset and liability measurement and accounting policy decisions that were made to maintain regulatory capital (LICAT) stability.”

Key Financial Highlights

2 Base EPS and base return on equity are non-GAAP ratios. Refer to the "Non-GAAP Financial Measures and Ratios" section of this document for additional details.

3 Base return on equity and return on equity are calculated using the trailing four quarters of applicable earnings and common shareholders' equity.

Base earnings per common share (EPS) for the first quarter of 2023 of $0.87 were up 14% from $0.76 a year ago. The increase was primarily due to Prudential related base earnings of $69 million (US$51 million), higher contributions from investment experience and realized synergies from the MassMutual acquisition as well as more favourable group insurance long term disability experience in the Canada segment. These items were partially offset by lower fee income in the U.S. segment as well as unfavourable mortality experience in the Canada, Europe and Capital and Risk Solutions segments. Under the IFRS17 reporting standard, the positive benefits of longevity gains mainly flow through the Contractual Service Margin and no longer immediately offset the impact of unfavorable mortality in earnings in the period.

Reported net EPS for the first quarter of 2023 was $0.64, compared to $1.43 a year ago, primarily due to unfavourable experience on non-fixed income assets and declining risk free rates in-quarter compared to positive contributions in the same quarter last year from rising interest rates.

Return on equity was 13.4% on net earnings and 15.8% on base earnings in the first quarter of 2023.

Highlights

New Value Drivers, with enhanced reporting

- The Company introduced three Value Drivers for describing its business: Workplace Solutions, Wealth & Asset Management and Insurance & Risk Solutions. These Value Drivers reflect the company’s business strategy and provide greater clarity and transparency into how the Company is creating value for shareholders and growing the business.

Strategic acquisition to build a leading platform for independent advisors in Canada

- Subsequent to the first quarter of 2023, on April 3, 2023, Canada Life announced an agreement to acquire Investment Planning Counsel Inc. (IPC), a leading independent wealth management firm, from IGM Financial Inc. (IGM). This acquisition accelerates our strategy of building the leading platform for independent advisors in Canada. With this acquisition, Canada Life will be one of the largest non-bank wealth providers in the country.

Empower launches Empower Personal Wealth

- Empower launched Empower Personal Wealth with an expanded focus on retail wealth management. Empower is working to make money management simpler, clearer, and more accessible by bringing together everything a customer owns and owes in one comprehensive dashboard that they and their advisor can leverage to take control of their personal wealth.

Irish Life launches Unio, a new independent, wealth management advisory firm

- Irish Life combined its recently acquired Irish brands: Invesco, Acumen and APT under Unio Financial Services Ltd, a single wealth management umbrella. The new firm will provide expert advice for thousands of individuals who are currently either under-advised, or not being serviced at all on how to effectively manage their wealth. Underpinned by a market-leading digital platform, Unio will provide personalized client advice and investment solutions to a growing and underserved population.

Successful transition to IFRS 17

- The Company has adopted and successfully implemented IFRS 17 and 9 effective January 1, 2023. This milestone marks the culmination of a multi-year enterprise-wide initiative. The new reporting regime provides improved visibility as to the strong, underlying economics and diversification of Lifeco’s portfolio through enhanced disclosures and metrics. The transition to the new standards did not have a material impact on the Company. The accounting change does not impact the underlying economics of the Company’s business activities nor change the Company's business strategy.

SEGMENTED OPERATING RESULTS

For reporting purposes, Lifeco’s consolidated operating results are grouped into five reportable segments – Canada, United States, Europe, Capital and Risk Solutions and Lifeco Corporate – reflecting the management and corporate structure of the Company. For more information, refer to the Company’s first quarter of 2023 interim Management’s Discussion and Analysis (MD&A).

CANADA

- Q1 Canada segment base earnings of $278 million and net earnings of $233 million – Base earnings of $278 million increased by $54 million compared to the same quarter last year, primarily due to more favourable group insurance long term disability morbidity experience, pricing actions in the Group Life & Health business as well as higher earnings on surplus, partially offset by unfavourable individual insurance mortality experience.

- Items excluded from base earnings were negative $45 million compared to positive $219 million for the same quarter last year. Market experience losses were $43 million in the first quarter of 2023 due to declining interest rates compared to gains of $226 million in the same quarter last year due to rising interest rates.

UNITED STATES

- Q1 Empower base earnings of US$186 million ($251 million) and net earnings of US$150 million ($202 million) – Empower base earnings for the first quarter of 2023 were US$186 million ($251 million), up US$67 million or 56% from the first quarter of 2022. The increase was primarily due to an increase of US$51 million related to the Prudential acquisition, as well as higher contributions from investment experience and realized synergies from the MassMutual acquisition. These items were partially offset by lower fee income driven by lower average equity markets.

- Items excluded from base earnings were negative US$36 million ($49 million) compared to negative US$26 million ($33 million) for the same quarter last year, primarily due to higher integration costs related to the Prudential acquisition, partially offset by the non-recurrence of integration costs related to the acquisition of Personal Capital incurred in the same quarter last year.

- Q1 Asset Management base loss of US$20 million ($27 million) and net loss of US$21 million ($29 million) – Asset Management base loss for the first quarter of 2023 was US$20 million ($27 million), compared to a base loss of US$1 million ($2 million) in the first quarter of 2022, primarily due to lower other-AUM based fee income, partially offset by higher net investment income and lower volume-driven expenses.

- Items excluded from base earnings of negative US$1 million ($2 million) were comparable to the same period last year.

EUROPE

- Q1 Europe segment base earnings of $178 million and net earnings of $40 million – Base earnings of $178 million increased by $2 million compared to the same quarter last year, primarily due to favourable insurance and annuity results in the U.K. driven by a favourable reinsurance settlement gain as well as favourable impact of changes to certain tax estimates. These items were partially offset by higher mortality claims experience in Ireland.

- Items excluded from base earnings for the first quarter of 2023 were negative $138 million compared to positive $368 million for the same quarter last year. The decrease was primarily due to negative returns on non-fixed income assets and declining risk free interest rates in-quarter compared to positive contributions from non-fixed income assets and rising interest rates in the same quarter last year.-

CAPITAL AND RISK SOLUTIONS

- Q1 Capital and Risk Solutions segment base earnings of $157 million and net earnings of $184 million Base earnings of $157 million decreased by $14 million compared to the same quarter last year, primarily due to unfavourable mortality experience in the U.S. life business. The decrease was partially offset by growth in the structured business and improved property catastrophe product margins.

- Items excluded from base earnings were positive $27 million compared to positive $63 million for the same quarter last year driven by lower than expected net investment results as a result of declining interest rates in 2023 compared to rising interest rates in the same period in 2022 and inflation impacts.

QUARTERLY DIVIDENDS

The Board of Directors approved a quarterly dividend of $0.52 per share on the common shares of Lifeco payable June 30, 2023 to shareholders of record at the close of business May 31, 2023.

In addition, the Directors approved quarterly dividends on Lifeco's preferred shares, as follows:

First Preferred Shares |

Amount, per share |

Series G |

$0.3250 |

Series H |

$0.30313 |

Series I |

$0.28125 |

Series L |

$0.353125 |

Series M |

$0.3625 |

Series N |

$0.109313 |

Series P |

$0.3375 |

Series Q |

$0.321875 |

Series R |

$0.3000 |

Series S |

$0.328125 |

Series T |

$0.321875 |

Series Y |

$0.28125 |

For purposes of the Income Tax Act (Canada), and any similar provincial legislation, the dividends referred to above are eligible dividends.

First Quarter Conference Call

Lifeco's first quarter conference call and audio webcast will be held on Wednesday, May 10 at 8:00 am ET.

The conference call will be extended by 30 minutes, concluding at 9:30 am ET, to accommodate review of the first quarter 2023 results as well as the comparative 2022 results reported for the first time under the adoption of IFRS 17, Insurance Contracts and IFRS 9, Financial Instruments.

The call and webcast can be accessed through greatwestlifeco.com/news-events/events or by phone at:

- Participants in the Toronto area: 416-915-3239

- Participants from North America: 1-800-319-4610

A replay of the call will be available until June 10 and can be accessed by calling 604-674-8052 or 1-855-669-9658 (passcode: 9666). The archived webcast will be available on greatwestlifeco.com.

Selected financial information is attached.

GREAT-WEST LIFECO INC.

Great-West Lifeco is an international financial services holding company with interests in life insurance, health insurance, retirement and investment services, asset management and reinsurance businesses. We operate in Canada, the United States and Europe under the brands Canada Life, Empower, Putnam Investments, and Irish Life. At the end of 2022, our companies had approximately 31,000 employees, 234,500 advisor relationships, and thousands of distribution partners – all serving over 38 million customer relationships across these regions. Great-West Lifeco trades on the Toronto Stock Exchange (TSX) under the ticker symbol GWO and is a member of the Power Corporation group of companies. To learn more, visit greatwestlifeco.com.

Basis of presentation

The condensed consolidated interim unaudited financial statements for the period ended March 31, 2023 of Lifeco, which reflects the adoption of IFRS 17, Insurance Contracts, and IFRS 9, Financial Instruments that resulted in the restatement of certain comparative amounts, have been prepared in accordance with International Financial Reporting Standards (IFRS) unless otherwise noted and are the basis for the figures presented in this release, unless otherwise noted.

Cautionary note regarding Forward-Looking Information

This release contains forward-looking information. Forward-looking information includes statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as "will", "may", "expects", "anticipates", "intends", "plans", "believes", "estimates", "objective", "target", "potential" and other similar expressions or negative versions thereof. Forward-looking information includes, without limitation, statements about the Company's operations, business (including business mix), financial condition, expected financial performance (including revenues, earnings or growth rates and medium-term financial objectives), ongoing business strategies or prospects, climate-related and diversity-related measures, objectives and targets, anticipated global economic conditions and possible future actions by the Company, including statements made with respect to the expected cost, benefits, timing of integration activities and timing and extent of revenue and expense synergies of acquisitions and divestitures, including but not limited to the proposed acquisition of Investment Planning Counsel (IPC) and the acquisition of the full-service retirement business of Prudential, expected capital management activities and use of capital, estimates of risk sensitivities affecting capital adequacy ratios, expected dividend levels, expected cost reductions and savings, expected expenditures or investments (including but not limited to investment in technology infrastructure and digital capabilities and solutions), the timing and completion of the proposed acquisition of IPC, the impact of regulatory developments on the Company's business strategy and growth objectives.

Forward-looking statements are based on expectations, forecasts, estimates, predictions, projections and conclusions about future events that were current at the time of the statements and are inherently subject to, among other things, risks, uncertainties and assumptions about the Company, economic factors and the financial services industry generally, including the insurance, mutual fund and retirement solutions industries. They are not guarantees of future performance, and the reader is cautioned that actual events and results could differ materially from those expressed or implied by forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance that they will prove to be correct. In all cases, whether or not actual results differ from forward-looking information may depend on numerous factors, developments and assumptions, including, without limitation, assumptions around sales, fee rates, asset breakdowns, lapses, plan contributions, redemptions and market returns, the ability to integrate the acquisitions of Personal Capital and the retirement services businesses of MassMutual and Prudential, the ability to leverage Empower's, Personal Capital's, MassMutual's and Prudential's retirement services businesses and achieve anticipated synergies, customer behaviour (including customer response to new products), the Company's reputation, market prices for products provided, sales levels, premium income, fee income, expense levels, mortality experience, morbidity experience, policy and plan lapse rates, participant net contribution, reinsurance arrangements, liquidity requirements, capital requirements, credit ratings, taxes, inflation, interest and foreign exchange rates, investment values, hedging activities, global equity and capital markets (including continued access to equity and debt markets), industry sector and individual debt issuers' financial conditions (particularly in certain industries that may comprise part of the Company's investment portfolio), business competition, impairments of goodwill and other intangible assets, the Company's ability to execute strategic plans and changes to strategic plans, technological changes, breaches or failure of information systems and security (including cyber attacks), payments required under investment products, changes in local and international laws and regulations, changes in accounting policies and the effect of applying future accounting policy changes, changes in actuarial standards, unexpected judicial or regulatory proceedings, catastrophic events, continuity and availability of personnel and third party service providers, the Company's ability to complete strategic transactions and integrate acquisitions, unplanned material changes to the Company's facilities, customer and employee relations or credit arrangements, levels of administrative and operational efficiencies, changes in trade organizations, and other general economic, political and market factors in North America and internationally.

The reader is cautioned that the foregoing list of assumptions and factors is not exhaustive, and there may be other factors listed in other filings with securities regulators, including factors set out in the Company's 2022 Annual MD&A under "Risk Management and Control Practices" and "Summary of Critical Accounting Estimates" and in the Company's annual information form dated February 8, 2023 under "Risk Factors", which, along with other filings, is available for review at www.sedar.com. The reader is also cautioned to consider these and other factors, uncertainties and potential events carefully and not to place undue reliance on forward-looking information.

Other than as specifically required by applicable law, the Company does not intend to update any forward-looking information whether as a result of new information, future events or otherwise.

Cautionary note regarding Non-GAAP Financial Measures and Ratios

This release contains some non-GAAP financial measures and non-GAAP ratios as defined in National Instrument 52-112 “Non-GAAP and Other Financial Measures Disclosure”. Terms by which non-GAAP financial measures are identified include, but are not limited to, "base earnings (loss)", "base earnings (loss) (US$)" and "assets under administration". Terms by which non-GAAP ratios are identified include, but are not limited to, “base earnings per common share (EPS)”, and “base return on equity (ROE)”. Non-GAAP financial measures and ratios are used to provide management and investors with additional measures of performance to help assess results where no comparable GAAP (IFRS) measure exists. However, non-GAAP financial measures and ratios do not have standard meanings prescribed by GAAP (IFRS) and are not directly comparable to similar measures used by other companies. Refer to the "Non-GAAP Financial Measures and Ratios" section in this release for the appropriate reconciliations of these non-GAAP financial measures to measures prescribed by GAAP as well as additional details on each measure and ratio.

For more information:

Media Relations

Liz Kulyk

204-391-8515

media.relations@canadalife.com

Investor Relations

Deirdre Neary

647-328-2134

deirdre.neary@canadalife.com

Downloads